Obligation from July 1... or maybe from October 1, 2022

Pursuant to § 4 (1) (2) (m) of Regulation of the Minister of Finance of December 28, 2021, on exemptions from the obligation to keep sales records using cash registers (the Journal of Laws, item 2442), the absolute obligation to cover registration on fiscal devices were involved the services of “washing, cleaning cars and similar services (Number of Polish Classification of Goods and Services [PKWiU] 45.20.30.0), including the use of devices operated by the customer, which, in a maintenance-free system, accept the amount due in coins or banknotes or in another (non-cash) form”. Deadline for this obligation in § 7. The regulations were set for July 1, 2022.

According to the information provided via the website of the Ministry of Finance, this date will be postponed to October 1, 2022 (we will inform you about the signing of the relevant Regulation).

This means that cash registers will appear at all car wash stations on October 1, at the latest.

Which cash register to select?

First of all, it must be a cash register that has a valid approval of the President of the Central Office of Measures - only such cash registers can be used by the taxpayer to fulfill the obligation imposed by the legislator to register sales and services using a cash register.

In the case of car washes and self-service devices, there is another important legal aspect that should be paid attention to. Regulation of the Minister of Finance of April 29, 2019, on cash registers (the Journal of Laws, item 816), § 7 (3) clearly states:

§ 7. 3. In the case of a particular type of sale or a special method of keeping records, for which it is required to keep records using cash registers with a special use, taxpayers are obliged to use these cash registers.

An automatic car wash and all devices on it for washing and cleaning motor vehicles are a place of "special record keeping", even though the lack of a person operating the cash register. For this reason, specialized devices must be installed in car washes.

The aforementioned Regulation on cash registers defines the types of cash registers as follows:

§ 7. 1. Taxpayers, due to the purpose of keeping records of a given type of sales or in a given way, use the following cash registers:

1) general cash registers - to keep turnover records in a manner that does not require the use of special functions and construction solutions;

2) special purpose cash registers - with a construction and work program considering the specific application of these cash registers and fulfilling specific criteria and technical conditions set out in the regulation relating to specific forms of trading or sales of certain goods and services or the need for cooperation with other equipment necessary for this type of activity, including cash registers:

......

f) installed in devices for the automatic sale of goods and services.

Just as general cash registers cannot be used in pharmacies and in communication/transport (a special way...), only in accordance with the aforementioned provision, they must be devices specialized in pharmacies or in transporting people/ticket holders, just as general cash registers cannot be used for automatic (maintenance-free) sales. These must be cash registers with special use, in accordance with § 7. (1.1) of the aforementioned Regulation. Using a solution with the approval of a "general purpose" cash register, the taxpayer – the owner of the car wash exposes itself to "penal and fiscal unpleasantness" for violating the provisions of the Regulation - experienced at that time the owners of buses who used ordinary cash registers to register passenger transport services.

Obligation to use specialized cash registers (in accordance with § 7. (1. 2) (f) at car washes is also confirmed in the answers to the questions asked by the National Tax Information.

The obligation to use a specialised cash register, intended for placing in devices for automatic sale of goods, allows not to print paper receipts for customers purchasing vehicle washing and cleaning services. The Ministry of Finance has specified this precisely on its website:

The Ministry of Finance: "Taxpayers running business using automatic machines and using cash registers to keep sales records may not issue a fiscal receipt and a fiscal receipt cancelled in paper form, if they provide the buyer with the opportunity to read the sales data by displaying them on the device for automatic sale of goods and services in the manner specified in the provisions on technical requirements (criteria and technical conditions) for cash registers - the above is regulated by § 12 of the Regulation on cash registers"

The possibility of getting acquainted on the cash register display with the data of the receipt specified in the Regulation is given by fiscal devices with approval for specialized devices placed in devices for automatic sale of goods and services.

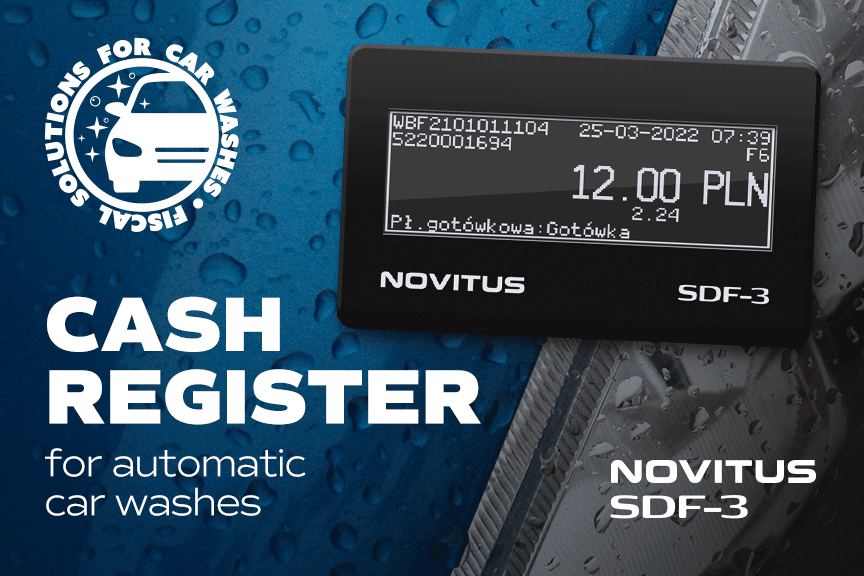

The Regulation specifies that the cash register display must show to the buyer for 30 seconds the details of the receipt:

- unique number of the cash register,

- tax identification number (NIP) of a taxpayer,

- sale date,

- subsequent receipt number,

- total gross sale value,

- total amount of tax,

- type of payment method,

- other payment methods.

Another way of presenting the receipt (e.g. the QR code itself or a link to download an electronic receipt) does not meet the requirements of the aforementioned Regulation.

In addition, it is worth noting that the issuance of a receipt in electronic form (e-receipt) to the buyer is possible only with the consent of the customer and in a manner agreed with the customer. If the buyer does not have a smartphone when paying for the service and is unable to read the QR code which is a link to the actual fiscal receipt, the receipt must be displayed in accordance with the Regulation or the receipt must be printed. Otherwise, the taxpayer is not able to issue a receipt to the buyer and the buyer itself is deprived of the possibility of receiving it. This violates the obligations of the taxpayer using the cash register.

Where should the cash register be installed at the car wash?

Taxpayers keeping records using cash registers are obliged to issue and provide to the buyer, without its request, a fiscal receipt when making the sale, no later than upon receipt of receivables, regardless of the form of payment (§ 6. (1. 1) Regulation of the Minister of Finance on cash registers)). This means that the receipt should be registered and issued or displayed no later than upon receipt of payment for the service. The place of business is any car wash station that accepts payment for services (regardless of the form of payment). This means that a cash register must be installed at each such post where the payment is accepted, which will register the receipt and issue it to the customer or display the details of this receipt.

This was also determined by the Ministry of Finance in response to the first question on the website: https://www.podatki.gov.pl/vat/wysasenia/kasy- Rejestrujace-w-automatach

"At this stage, no solutions have been provided for the industry to create a central cash register to which the positions in the area from a given car wash would be attached". - in this way, the Ministry of Finance, in the response of the Deputy Minister of Finance, Artur Soboń, to the parliamentary question (posted on the website of the Sejm), clearly stated that "central cash registers" fiscalising services from several positions may not be used in car washes.

The owner of the car wash must sign a statement.

§ 8 of Regulation of the Minister of Finance of May 26, 2020, on cash registers in the form of software (the Journal of Laws item 957) specifies the obligations of the taxpayer using the cash register. One of the obligations is the preparation and signing of the statement by the cashier - in the case of cash registers placed in machines, the statement is signed by the owner of the cash register - in which it declares that it has read the obligations imposed in the Regulation. The form of the statement is specified in Annex 3 to the aforementioned Regulation. Such an obligation is, for example:

- obligation to record using the cash register of any sale of goods or services to a natural person,

- obligation to issue and provide with a fiscal receipt to the buyer, even without its request,

- a fiscal receipt is to be issued to the buyer at the latest upon receipt of the receivable, regardless of the form of payment.

Part B of the aforementioned Annex 3 to the Regulation specifies the effects of non-compliance with the rules of keeping sales records using cash registers, issuing and providing a fiscal receipt:

A person selling without a cash register or failing to issue a fiscal receipt may be fined for a fiscal offence or a fiscal misdemeanour (pursuant to Article 62 § 4 and 5 of the Act of September 10, 1999 – Fiscal Penal Code (the Journal of Laws of 2020, items 19, 568 and 695)).

How do I integrate the cash register into the car wash?

There are many possibilities of integrating the cash register with the car wash. Of course, everything depends on the type and capabilities of the car wash. The most popular way to integrate the cash register with the car wash is to connect it to the information transferred from the coin inlet or the payment terminal to the car wash control unit itself (vacuum cleaner, cleaning device, etc.). Such information can be obtained from pulse signals, data transmitted by the CC Talk or MDB protocol. The appropriate configuration and software of the cash register will allow to determine what denomination the coin was inserted and what amount should be "taxed" on the fiscal receipt and the appropriate VAT tax calculated from it. In addition, in the same way, it is possible to obtain data from the payment terminal installed at the car wash. The correct configuration allows the cash register to record on the receipt whether the payment for the service was made in cash or by payment card.

Another way of integrating the cash register with the car wash is the possibility of transferring data to the cash register from the car wash computer via the communication protocol. This functionality will be provided by modern car washes, controlled by a computer system.

Will the cash register "fiscalise" tokens?

In addition to coins, tokens purchased at special points are also thrown into the inlets of the car washes. Their fiscalisation occurs at the time of selling them - the buyer should then receive a fiscal receipt or invoice for their purchase.

The proper configuration of the coin inlets and the information transferred from it to the cash register makes it possible to omit the fiscalisation of the tokens thrown in, in order to avoid double registration and double taxation of this service.

Will the calibration of the inlets also be "fiscalised"?

At the car washes, there are various works, which for car washes are service works. Repeated insertion of coins for the purpose of calibrating the inlet, washing devices and washing stations, test washing - these are just such operations. Since they are not services, they should not be included in the turnover of the car wash and should not be subject to VAT. For this reason, the cash register has a "service mode", which, after starting, is indicated on the cash register display along with the time remaining until its completion. After the programmed time (10 minutes), the cash register will automatically return to normal operation mode, and it will be possible to register services and display receipts.

How do I connect the cash register at the car wash to the Central Cash Register Repository?

The cash registers offered at the car wash must be on-line. This means that according to the Act, the taxpayer is obliged to provide the cash register with an internet connection to CRK. Such a connection can be made via the internet available at the car wash (often there is an internet there to provide access to monitoring, card payments, etc.). The cash register can be connected to the internet via LAN (Ethernet), WLAN (WiFi) or - in the case of lack of internet at a given car wash - via a GSM modem.

An internet connection is also needed for the owner of the car wash to communicate with the cash register - through a special website, it will have access to the cash register, receipts registered on it, its configuration, etc.

How do I receive a receipt from the cash register with the buyer's tax ID number?

Until now, when paying for services at an automatic car wash, the customer could not collect a receipt, a receipt with the VAT number of the buyer or a VAT invoice for the service - this was only possible by purchasing tokens or cards at special points of sale. Along with the installation of the cash register at the car wash, it is possible to receive a receipt for the service in electronic form as well as a receipt with the tax identification number of the buyer. A receipt with the VAT number of the buyer (simplified VAT invoice) gives the opportunity to settle such a service in the company. A special QR code with the appropriate information should be affixed next to the coin inlet or display. This QR code must be read by your smartphone BEFORE PAYMENT can be made. On a special website, which will be opened after reading it, confirm the address of the car wash, then enter the buyer's tax ID (or leave a blank field), it is necessary to enter the correct e-mail address. Only then do the payment for the service (insert coins or pay with a payment card). In addition to displaying the receipt data on the cash register display, the e-receipt generated by it will be displayed on the website opened on the smartphone and sent to the e-mail address provided.